Automotive & mobility

B2B

Transforming a 40-year-old automotive intelligence platform to compete in a rapidly evolving data economy

Client

Model

Services

Info

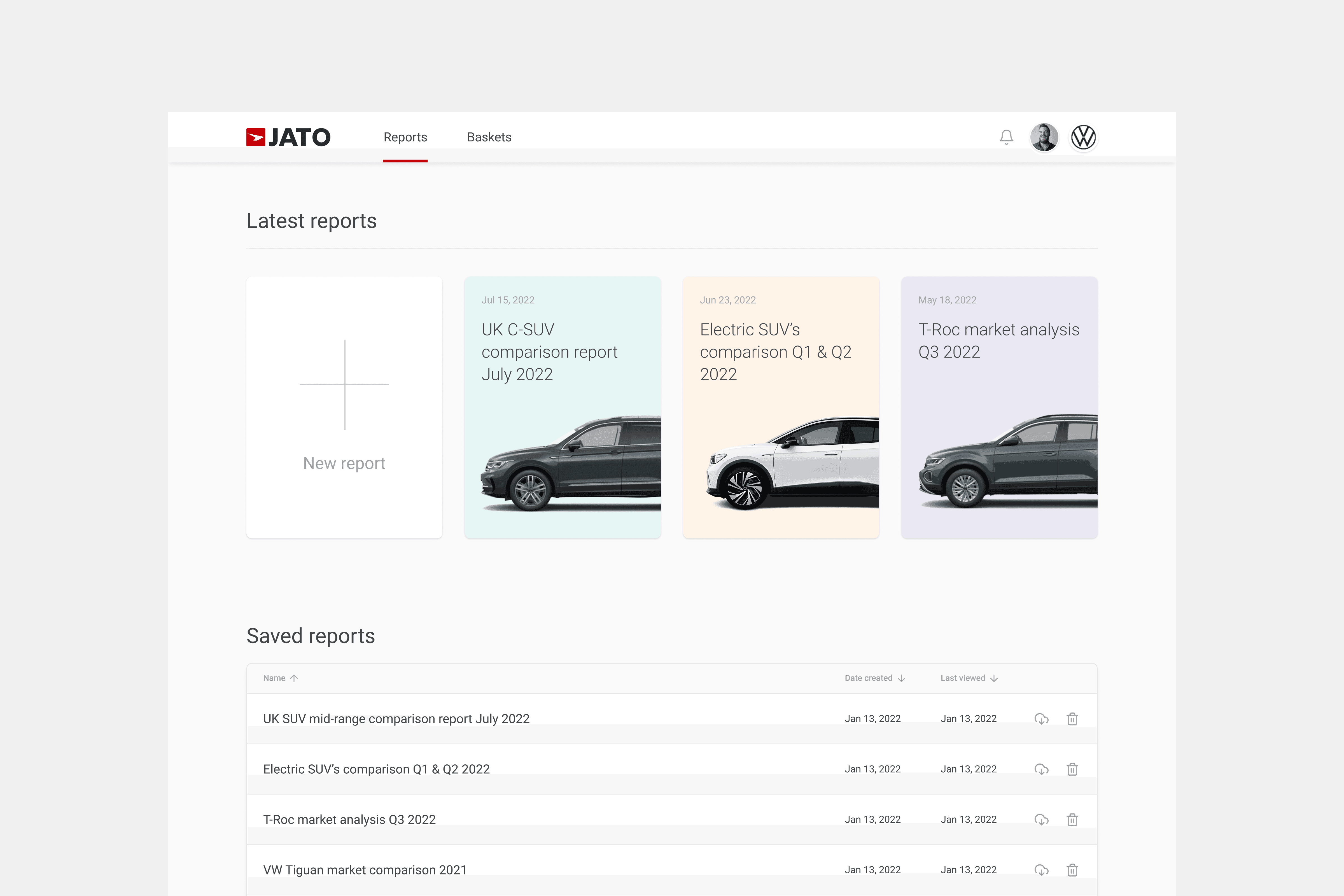

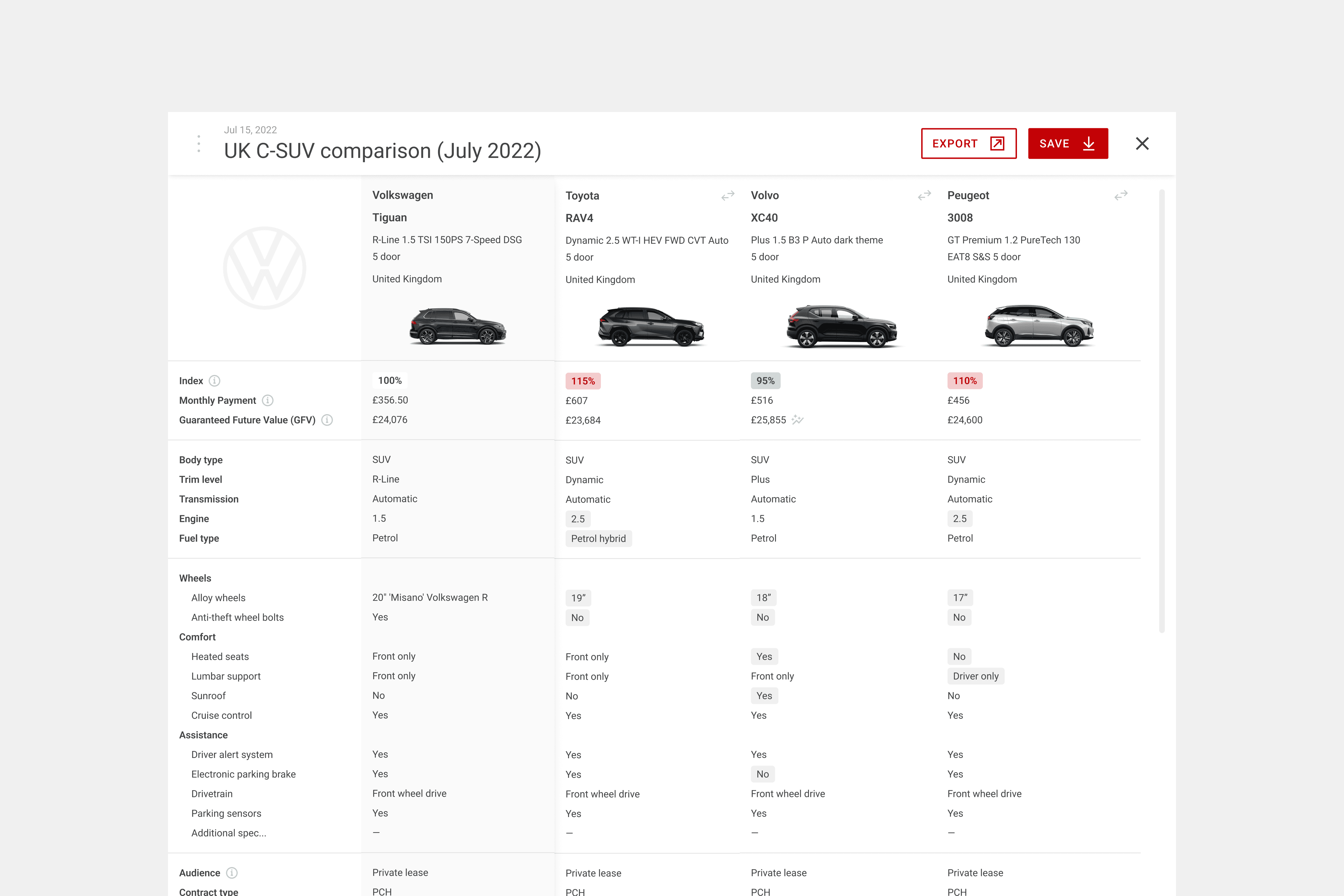

JATO Dynamics needed to transform from a legacy data provider into a modern intelligence platform to respond to changing client demands and capture new market categories.

JATO required fundamental transformation of how they understood and served customers across 50+ countries.

Challenge

JATO faced three challenges: product teams were disconnected from customers, legacy assumptions were misaligned with market realities and siloed verticals operating independently without shared insights.

This fragmentation limited competitive product development, whilst rivals increasingly offered integrated platforms with modern UX and reporting capability.

Our analysis

The JATO product team knew they had a problem but needed to cut through internal politics, process blockers and paralysed decision making to secure precious technical resources. A fundamental rethink of how JATO understood customer value and made product decisions was needed.

Application of evidence-based design thinking would unite teams and end decision paralysis.

What we did

Project impact

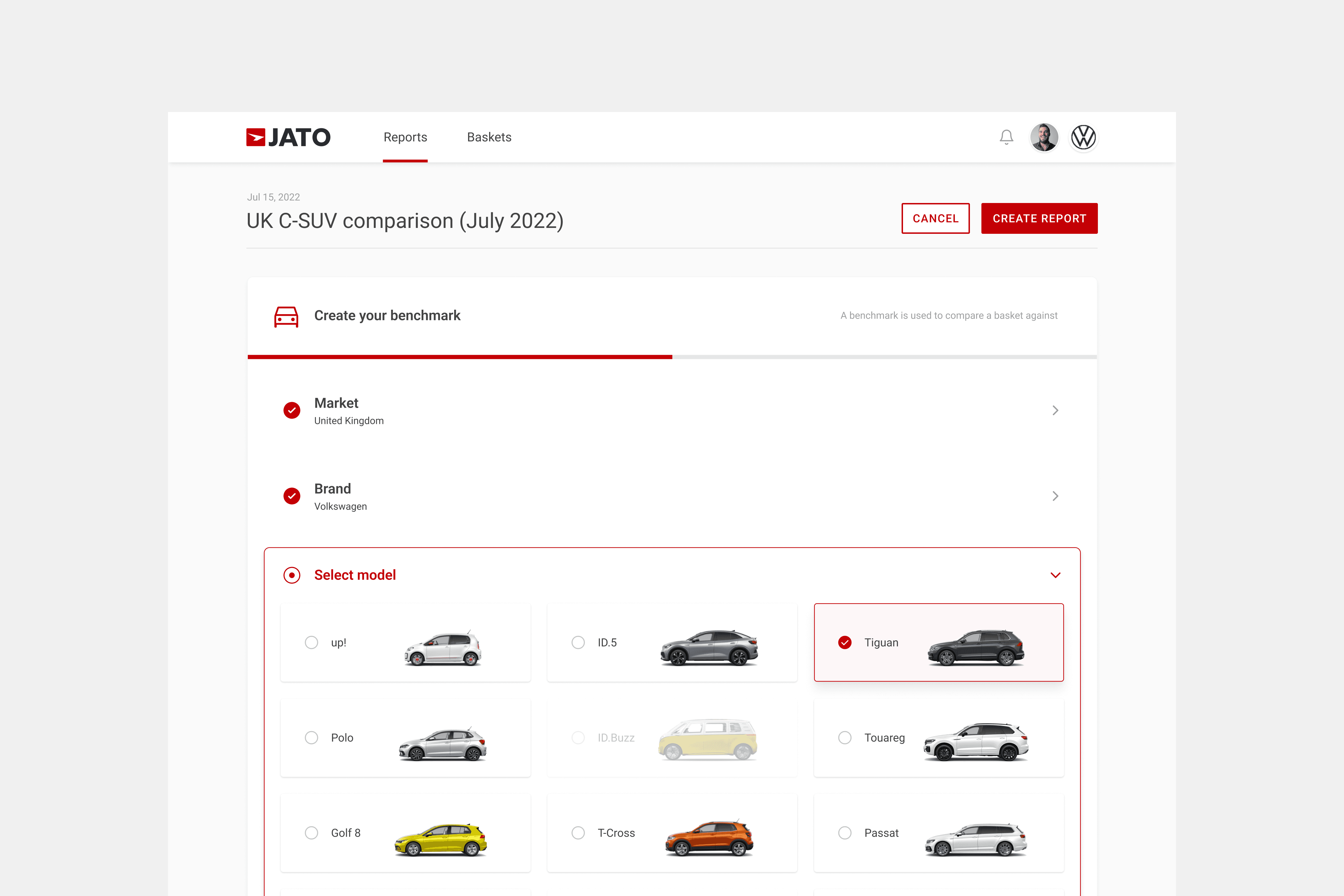

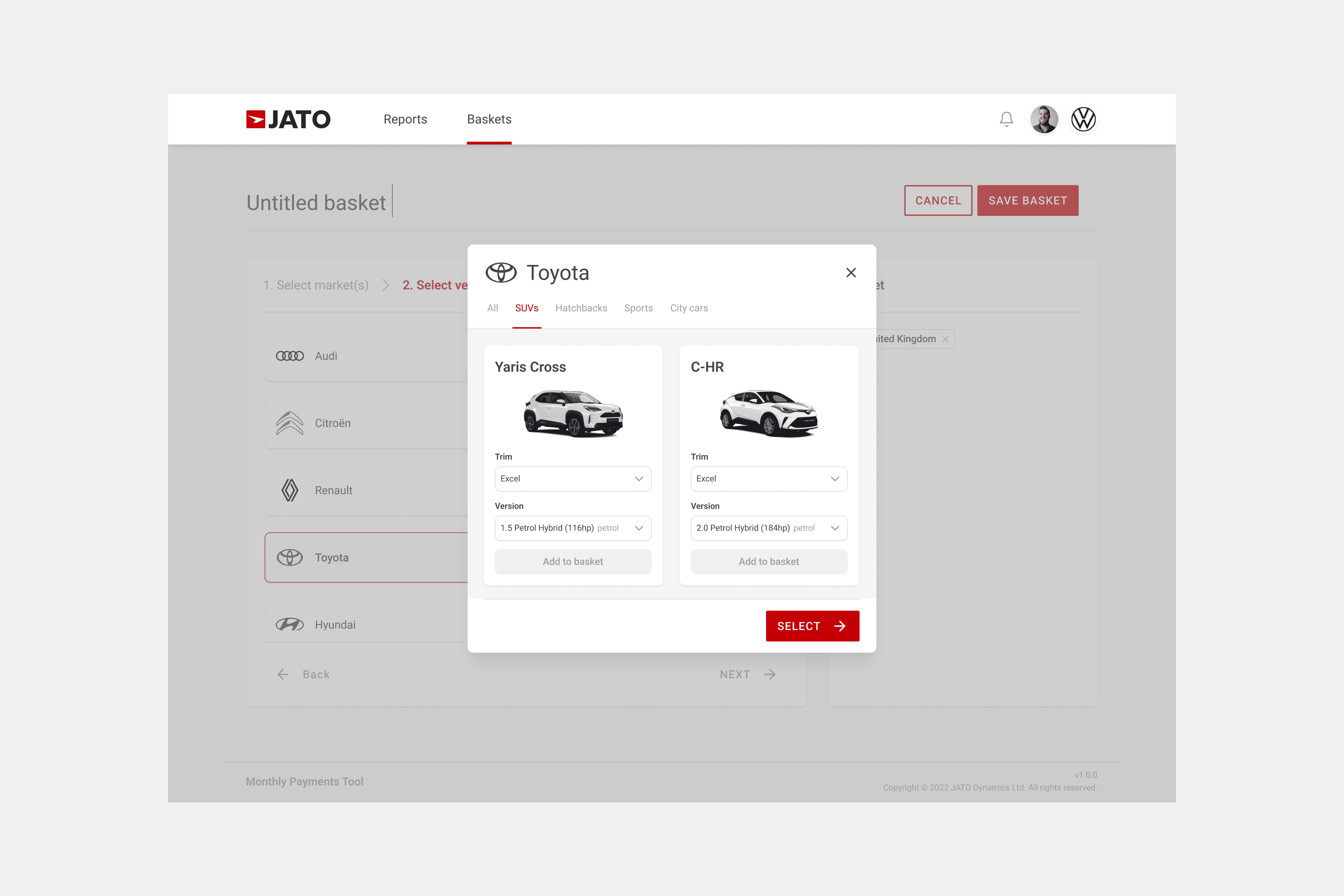

Turn customers into co-creators to build what matters and end internal debates

Established companies must transform legacy platforms for fast-changing digital markets - yet often lack direct customer input into decisions. Success requires co-creation that transforms customer insights into clear direction.

We specialise in customer co-creation for organisations whose internal assumptions have replaced market reality.

Our jobs-to-be-done approach makes customers active partners, enabling confident transformation without guessing.

Previous

Next